The Securities and Exchange Board of India (SEBI) is concerned about the rising activities in equity derivatives, especially in index derivatives. To manage this surge, SEBI has rolled out several measures. These include requiring option premiums to be paid upfront by buyers, ending the calendar spread advantage on expiry days, monitoring position limits throughout the day, increasing contract values, limiting weekly expiries to one index per exchange, and raising margin requirements on expiry days. These changes were announced in a circular in October.

While these measures will be implemented on different dates, they are expected to be fully in place by February. This will likely create a more challenging environment for participants in the equity futures and options (F&O) segment. Consequently, some traders might consider shifting to the commodity F&O market to diversify their portfolios. It’s important for them to understand how equity and commodity derivatives differ. Let’s explore these differences, the available products, and the rules that govern them.

While these measures will be implemented on different dates, they are expected to be fully in place by February. This will likely create a more challenging environment for participants in the equity futures and options (F&O) segment. Consequently, some traders might consider shifting to the commodity F&O market to diversify their portfolios. It’s important for them to understand how equity and commodity derivatives differ. Let’s explore these differences, the available products, and the rules that govern them.

Equity and commodity are Fundamentally Unalike

Equity and commodity investors share some common interests, like global economic trends, political situations, and the business landscape. However, they also have their unique characteristics. When you buy a stock, you’re purchasing a part of a company. The stock’s value depends on how well the company does, taking into account its profitability, balance sheet, and management quality, along with the overall economic conditions where it operates.

Commodities, on the other hand, are tangible goods whose prices are driven by supply and demand. Therefore, investors tend to take a broader, macroeconomic view when assessing them. Generally, commodities are more volatile and thus riskier than stocks, reacting to fluctuating macroeconomic conditions and changes in production and consumption. For instance, the annualized volatility of the Nifty 500 index stands at 16 percent, while crude oil shows 37 percent. Gold is comparatively stable with 14 percent volatility.

Different Forces at Play

Commodities can be split into four main categories: precious metals, base metals, energy, and agricultural commodities. This discussion will focus on the first three since agricultural commodities aren’t as active in the derivatives market.

Precious metals: When it comes to gold and silver, both production and consumption figures matter, but certain factors can quickly sway their prices. The movement of the dollar can greatly affect these metals, and so can decisions made by the US Federal Reserve or geopolitical events. Recently, gold prices have been influenced by the Fed’s gold purchases and international conflicts like the Russia-Ukraine war.

The performance of gold and silver since October 2022 reflects these pressures, with gold increasing by 62 percent and silver by 64 percent. This outpaced other commodities and even stock indices like the Nifty 50 and S&P 500. Gold, in particular, is seen as a refuge for investors when global growth concerns arise.

Base metals: Commonly traded base metals include aluminium, copper, lead, nickel, and zinc. Their market health is largely tied to China, the top consumer and producer of these metals. When the Chinese economy grows, it bodes well for these commodities.

Factors specific to each metal can also affect pricing. For example, despite a tough year for most metals in 2023, copper managed a slight gain due to high demand in China for renewable energy applications. Additionally, social unrest in countries like Peru and Chile—big players in copper and zinc production—can disrupt supply, leading to price increases.

Energy commodities: Crude oil and natural gas are often in the spotlight due to their importance and volatility, with annualized volatility rates of 37 percent and 55 percent, respectively. Monitoring inventory levels is crucial; unexpected increases in stockpiles can indicate lower demand and downward price pressures.

Demand for natural gas is especially sensitive to winter temperatures in Europe, where it’s used for heating. The Russia-Ukraine war has also significantly impacted natural gas prices, especially after Russia‘s invasion in 2022 caused prices to spike. However, an oversupply and milder winters have since caused prices to drop.

For crude oil, the OPEC+ production decisions are vital since they control a substantial share of the global market. Recent OPEC+ announcements regarding production cuts have influenced prices, but overall, persistent oversupply has kept crude oil prices under pressure despite regional conflicts.

Monitoring developments in these areas is essential for commodity traders to make informed choices.

Equity vs. Commodity Derivatives

Most brokerage firms that offer equity derivatives also allow access to commodity derivatives using a single trading account. The commodity market operates longer hours, from 9 a.m. to 11:30 or 11:55 p.m., compared to the equity market’s 9:15 a.m. to 3:30 p.m. However, while 223 stocks are available in the F&O space, the range is narrower for commodities.

Another key difference lies in the spot market. In equities, the market is vibrant, allowing trades based on stock indices or individual stocks. For commodities, the spot market isn’t as active, making it important to track international commodity performance, especially how the Indian currency fares against the dollar.

For example, copper has dropped by 7.5 percent in dollar terms since September-end. Thanks to the rupee‘s 2.2 percent depreciation in that time, copper’s decline in rupee terms is only 3.6 percent.

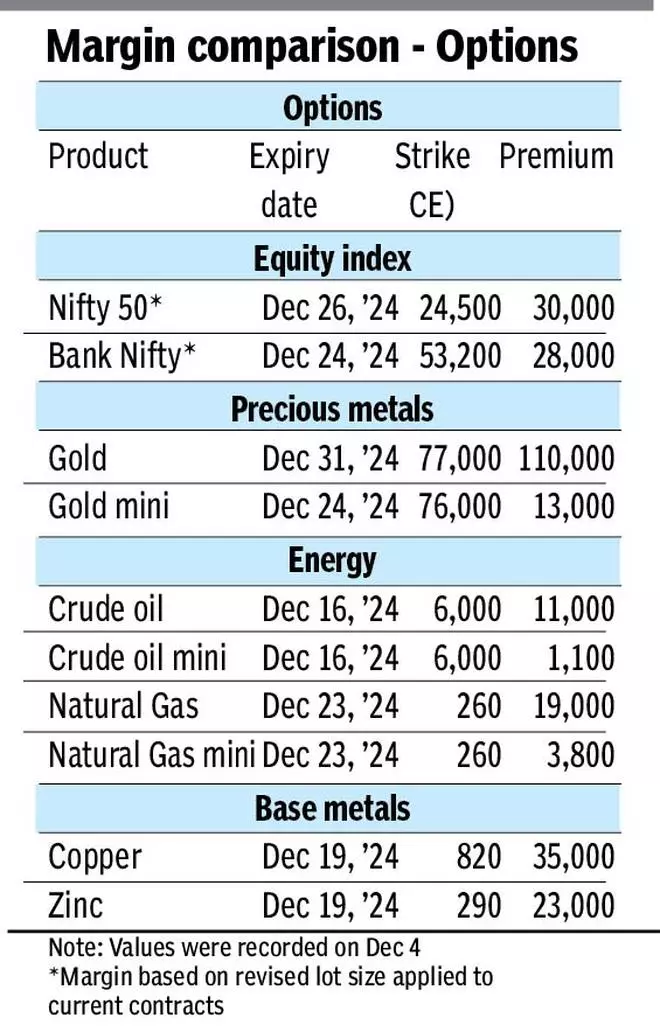

Options also vary between the two. In equity options, stocks are the underlying assets, while for commodities, futures contracts are used. For instance, if a gold call option expires in-the-money, it will convert into a long futures position.

If you hold a gold 77,000-call option and the gold futures price is ₹80,000 at expiry, the call option is in-the-money and will settle as a long position on gold futures at ₹77,000. You can then choose to exit or hold based on market conditions.

You can opt not to exercise options before expiry with a ‘contrary instruction.‘ Regarding futures, precious and base metals are delivery contracts, while energy commodities are cash settled.

As expiry approaches, margin requirements typically rise. For example, for gold and aluminium futures, these obligations can start increasing up to five and three days before expiry, respectively.

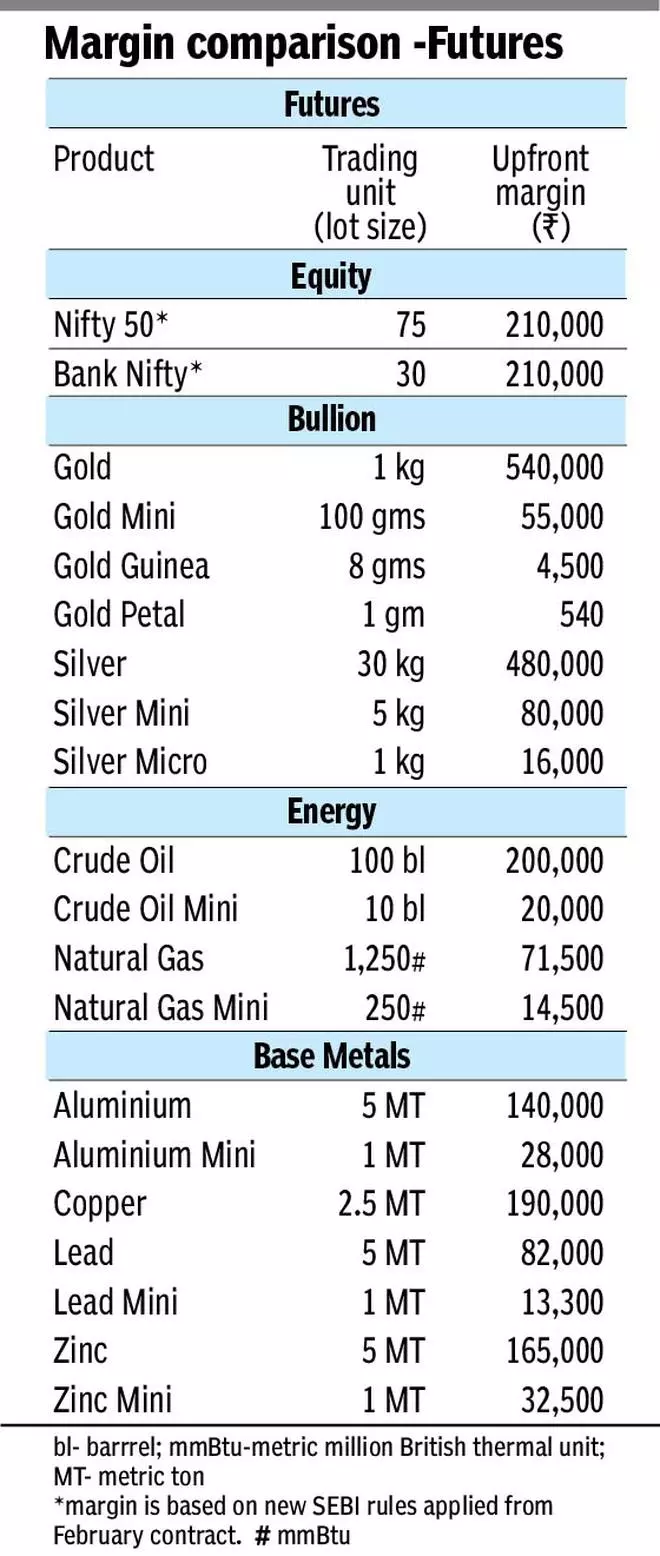

In equity futures, SEBI has set a standard contract value between ₹15 lakh and ₹20 lakh, unlike commodities, where contract values can vary widely. This variability can lead to significant margin requirements.

The upfront margin combines the initial margin and Extreme Loss Margin (ELM). For gold futures, these are 6 percent and 1 percent respectively. For instance, a gold futures contract worth over ₹77 lakh would require a margin of ₹5.4 lakh, while a smaller contract would need around ₹540.

When markets see unusually high volatility, exchanges can demand additional margins, sometimes as high as 50 percent. Traders also need to maintain a mark-to-market margin to cover unrealized losses.

Daily price limits are in place to prevent excessive speculation. In equities, both index and stock futures have a 10 percent limit. If reached, there’s a brief trading halt. For commodities, limits vary—3 percent for low-volatility goods like gold and 4 percent for high-volatility ones like natural gas. These can be expanded in steps if market movements exceed them.

Risks in commodities are notably higher than in stocks. Traders in commodities must stay alert. While stocks carry risks too, extreme price drops like those experienced in the oil markets in

2020 have been rare.

In early 2022, nickel prices surged over 100 percent due to market reactions linked to the Russia-Ukraine conflict.

Understanding these nuances can help traders navigate the commodities market more effectively.