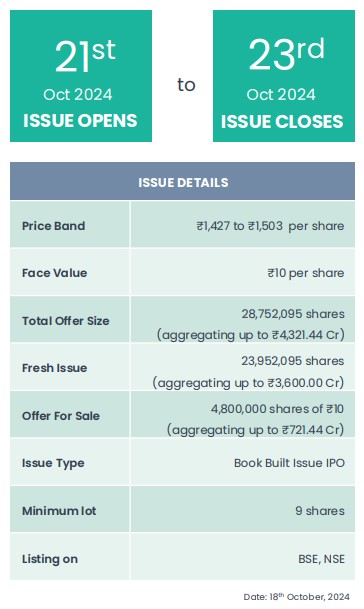

Waaree Energies Ltd IPO is likely to be a hot issue and will command a hefty premium on listing. It is a book built issue of Rs. 4,321.44 crores. The issue is a combination of Offer for Sale and Fresh Issue.

• The Fresh Issue consists of 2.4 crore shares aggregating to Rs. 3,600 crores at the upper end of the price band at Rs. 1,503 per share.

• The Offer for Sale consists of 0.48 crore shares aggregating to Rs. 722.41 crores at the upper end of the price band at Rs. 1,503 per share

With an installed capacity of 13.3 GW, Waaree Energies stands as India’s largest solar photovoltaic (PV) manufacturer.

• The nation’s ambitious goal of net-zero emissions has spurred rapid adoption of solar energy, with total installed capacity projected to reach 142 GW by 2029, presenting a robust demand outlook for Waaree’s products.

• The company faces direct competition from two listed peers, Websol Energy Services Ltd and Premier Energies Ltd, in a market dominated by private players.

• This IPO offers a concept-driven investment opportunity, and we anticipate potential traction and listing gains.

• We have issued a “SUBSCRIBE” rating for Waaree Energies Ltd’s IPO for listing gains