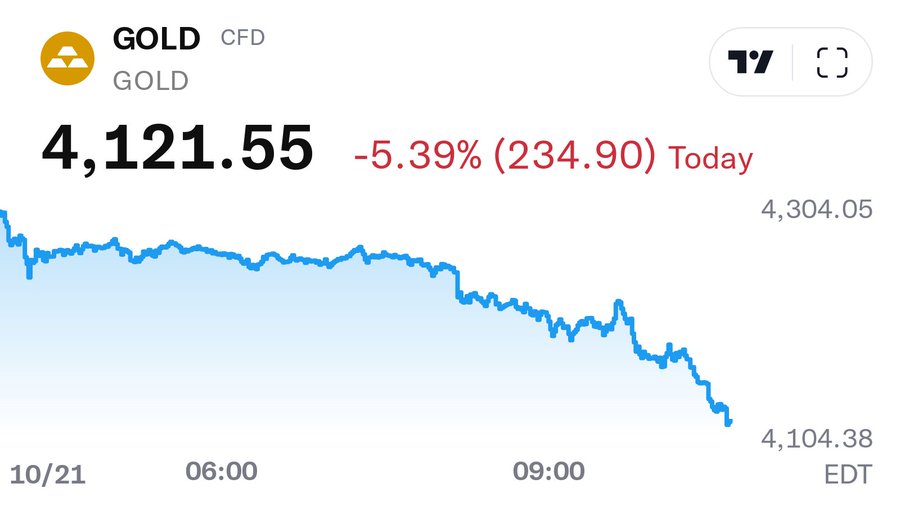

The precious metals market has been rocked by extreme volatility, experiencing a sharp sell-off immediately following an historic parabolic advance. Gold, which recently climbed to a new all-time high above $4,100, plunged by over $200, with spot gold last reported down nearly 5% at $4,214.29/oz. Silver mirrored the chaos, falling over 6% in a move described by analysts as a massive “shakeout.”

The sudden and brutal correction, which saw both metals rapidly relinquish gains, has ignited fervent debate among market commentators, with many viewing the sharp decline as a necessary, if painful, cleansing event typical of a powerful bull market.

The Great Gold Sell-Off and the Bitcoin Bid

Economist and long-time gold advocate Peter Schiff noted the magnitude of the move, stating, “Gold is now down over $200. Quite a shakeout, but all of this volatility is occurring with gold still above $4,100, which was a record high last week.”

Schiff, a known Bitcoin skeptic, pointed out an interesting market divergence: “Bitcoin is catching a bid from this selloff, creating another window for Bitcoiners to sell fool’s gold and buy the real thing.” This commentary highlights the ongoing narrative war between traditional and digital safe-haven assets, with a segment of capital rotation seemingly moving from the volatile yellow metal into cryptocurrency.

A Technical Correction or a Trend Reversal?

The technical outlook provided by analyst Christopher Aaron painted a stark picture of the potential downside. He cautioned that the $\$1,000$ rise in gold over the preceding three months could be almost entirely erased in a swift move. “There is ZERO support for gold on the chart until $\$3,435 – \$3,500$,” Aaron warned.

However, Aaron made it clear that a lack of chart support does not equate to a short opportunity, advising against “gambling” into a parabolic advance’s correction. Instead, he confirmed that he had taken profits and would only look to buy at “lower levels,” suggesting a tactical withdrawal rather than a complete change in his long-term bullish conviction.

The Silver Storm: Shakeout Before the Tsunami

The volatility was even more pronounced in the silver market. The metal’s steep 6% drop was interpreted by some, including Christopher Aaron, as a deliberate market maneuver. “This scary sell-off is designed not only to liquidate late buyers, but also to create an opportunity for shorts to exit their bleeding positions,” he argued.

This perspective suggests that powerful forces, anticipating a future price explosion, are exploiting the market’s thin liquidity to reset positions. Aaron framed the entire event as a “scary shakeout” that “won’t last long,” stating, “Storm before the tsunami.”

The underlying fundamentals supporting silver, including a structural supply squeeze and rising monetary demand, remain intact, lending credence to the “shakeout” theory. The rapid price decline quickly sparked calls for a swift recovery, with a move back toward the $53 zone considered unsurprising if the long-term momentum remains unchanged. As one market participant summarized, “Sharp price declines are typical of bull markets.3 Riding a bull isn’t as easy as many believe. It requires courage, strength, balance, and determination. Shocks are there to make weak hands fall.”

In summary, the immediate outlook for gold and silver is one of intense caution and high volatility. While the sharp, post-peak sell-off has flushed out speculative “late buyers,” many veteran analysts interpret the move not as a collapse of the bull market, but as a severe, healthy correction—a “shakeout”—that is setting the stage for the next, potentially explosive, leg of the precious metals rally. Investors are now keenly watching key technical levels to see if the metals can stabilize and confirm the anticipated “breakout” to new highs.